Competitor Intelligence

GDIC competitor intelligence gives you the thrust to always fly ahead of your competition.

Like a commander in a battlefield who relies on Intelligence as the basis for situation development, target value analysis, collection and reconnaissance and surveillance planning and battlefield decision-making, a capture manager needs reliable and current information on all other companies participating in a bid in order to develop a solid win strategy.

Levels of Competitor Intelligence

Competitor Intelligence can be performed at various levels with different granularity and for different purposes. We can categorize different types of Competitor Intelligence into three distinct levels:

- Strategic Competitor Intelligence: SCI focuses on longer-term issues such as key risks and opportunities facing the business. Corporate executives need a comprehensive view of the players in the market they are competing in to be able to formulate their strategy and to decide what services to offer, how to enter the market, and how to evaluate mergers and acquisition targets.

- Tactical Competitor Intelligence: TCI deals with finer grain and shorter-term type of intelligence, and seeks to provide insight into issues such as capturing market share or increasing revenues. Sales departments are the prime users of Tactical Competitive Intelligence. It is worth mentioning that, when trying to deduct lower level conclusions from findings of Strategic Competitive Intelligence, sales managers often find inconsistencies and sometimes even contradictions between what they expect to find in the market and what they actually encounter in reality. This is where Tactical Competitive Intelligence enters the picture to complement the conclusions drawn from Strategic CI and arm the company sales people with a deeper and more realistic picture of the competitive landscape they work in on a daily basis.

- Opportunity-Specific Competitor Intelligence: OSCI is even more finer grained than TCI. There are two factors that differentiate OSCI from other types of Competitive Intelligence: time period, and scope. OSCI lifetime usually starts with the first indications of a new opportunity, and ends with the contract award date. In terms of scope, it is limited to the competitive factors that significantly impact the outcome of the competition among the bidders.

Some companies may required competitor intelligence at all three levels, but others seek to acquire CI in only one level. For instance, a company may be interested in a comprehensive CI report, complemented by continuous monitoring of market activities of their key competitors for a long period, with the aim of refining their strategy and at the same time aligning their near-term activities in the market with other major players in their sector. On the other hand, a company may only be interested in CI in a particular high-value solicitation, something beyond what is usually covered in a Black Hat Review process.

GDIC offers competitor intelligence services at all three levels, individually or combined. Our analysts and information specialists are proficient in working on government contractors of all sizes and in every major industry.

Sources of Information

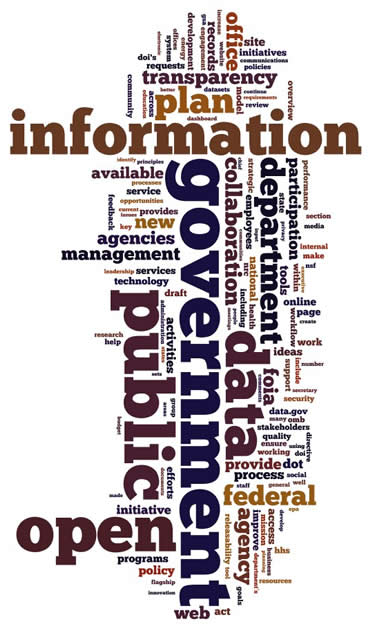

GDIC relies on information from thousands of federal government and other publicly available open data sources in its competitor information gathering and analysis activities. We never use data from proprietary sources.

When dealing with publicly available and open information sources, identifying relevant, reliable sources from the vast amount of available information is a major challenge. GDIC’s information engineers and analysts use their experience and GDIC’s vast knowledge base to select the best information sources and tailor the knowledge for each new project.

Some of the sources we use to collect competitive data are:

|

|

Competitor Intelligence Process

For each project, GDIC experts mine a large number data sources and structure the resulting data in a way that makes analyzing and extracting insight efficient. This process enables us to create a 360-degree view of your competitors.

In general, the process we follow in any Competitor Intelligence project comprises of the following steps:

- Define project objectives

- Identify competitors

- Decide on the information needed (Competitive Factors)

- Gather intelligence from publicly available sources

- Structure and shape the data based on the project objectives

- Analyze data, identify connections and patterns, and extract competitive factors

- Compare competitive factors and rank the competitors

- Perform SWOT analysis and create a Competitor Analysis Matrix

- Outline key findings and document the results

The outcome of the process will include, among other things, these important pieces of information about each competitor:

- Name and business profile

- Strategy and objectives

- Products and services

- Strengths and weaknesses

- Marketing strategy and tactics

- Market position

When focusing on a particular opportunity, the CI process will deliver information that defines what you are up against, including:

- Company statistics

- Contractor’s history working for the customer

- Competitor’s key contracts that give them credibility and strength

- Possible key personnel introduced in the opportunity

- Likely teaming arrangements

- Contractor’s liabilities

Tools and Technologies

At GDIC, we are well aware of the importance of competitive intelligence to our customers, and constantly thrive to use advanced and reliable technologies to provide our customers with high-quality results.

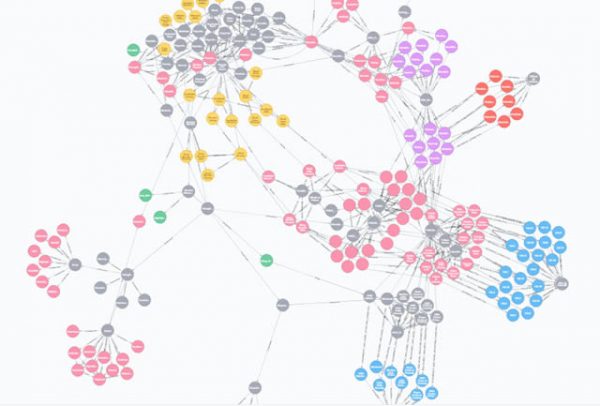

In continuously gathering strategic competitive intelligence, we deploy Robotic Process Automation. In addition to saving time and cost and providing our customers higher ROI, RPA enables GDIC data collectors to consistently and accurately collect and disseminate data from thousands of sources for long periods of time. Collected data is pre-processed by AI-enabled intelligent software that is able to semantically identify competitive information and tag them for later processing. Huge amounts of data are stored in Hadoop-based cloud data stores, and processed based on rules our analysts have defined. In a later stage, the tagged and filtered data is entered into a graph database where data nodes are setup and relationship among them are created. From here, pre-trained intelligent algorithms are used to discover patterns in the data, and extract the information related to the competitive factors that were specified in the earlier stages of the project.

These technologies complement the expertise and experience of our analysts and data specialists. They supervise the process and provide their valuable input where needed. The final analysis and report is a collective effort of a team of our analysts and data workers, aided by the technologies described above.